The release date:2025-09-05 viewed: The shop name:AAA

Unit: Yuan Currency: RMB

Key Accounting Data | Current Reporting Period (Jan.–Jun. 2025) | Same Period Last Year | Change (%) |

Operating Revenue | 19,569,225,716.54 | 19,837,572,517.98 | -1.35 |

Total Profit | 10,350,808,660.52 | 10,508,398,614.95 | -1.50 |

Net Profit Attributable to Shareholders of the Listed Company | 8,039,559,323.21 | 8,415,622,120.68 | -4.47 |

Net Profit Attributable to Shareholders of the Listed Company, Excluding Non-recurring Gains and Losses | 7,368,852,354.80 | 7,217,576,377.73 | 2.10 |

Net Cash Flows from Operations | 6,285,383,281.96 | 4,283,143,187.07 | 46.75 |

End of Current Reporting Period | End of Previous Year | Change (%) | |

Net Assets Attributable to Shareholders of the Listed Company | 136,608,147,910.02 | 133,306,892,061.01 | 2.48 |

Total Assets | 222,525,699,554.44 | 212,055,541,073.03 | 4.94 |

Key Financial Metrics | Current Reporting Period (Jan.–Jun. 2025) | Same Period Last Year | Change (%) |

Basic Earnings per Share (yuan/share) | 0.3459 | 0.3624 | -4.55 |

Diluted Earnings per Share (yuan/share) | 0.3458 | 0.3624 | -4.58 |

Basic EPS after Excluding Non-recurring Gains and Losses (yuan/share) | 0.3170 | 0.3107 | 2.03 |

Weighted Average Return on Net Assets (%) | 5.8804 | 6.6746 | -0.7942% |

Weighted Average ROE after Excluding Non-recurring Gains and Losses (%) | 5.3898 | 5.7244 | -0.3346% |

The port industry, as a fundamental sector of the national economy, is closely related to macroeconomic performance. In the first half of 2025, the industry faced complex global trade dynamics, frequent geopolitical conflicts, disruptions from the Red Sea crisis, the rise of trade protectionism, and the impact of U.S. “reciprocal tariffs” that accelerated shipping schedules. These factors contributed to a restructuring of global supply chains. In general, China’s overall imports and exports remained stable but showed significant regional divergence. Trade with the U.S. fluctuated sharply amid escalating frictions, while exports to the countries along the Belt and Road demonstrated resilience and stability. The international shipping market experienced volatility, heightened geopolitical risks, and rapid shifts in global shipping patterns, advancing port competition and cooperation into a new stage. Driven by megaship deployment, digitalization, automation, and greenization, the port industry now faces both new opportunities and challenges.

According to data from the Ministry of Transport of the People’s Republic of China, in the first half of 2025, nationwide port cargo throughput reached 8.903 billion tons, up 4.0% year on year, of which coastal ports handled 5.703 billion tons, up 2.5%. Nationwide container throughput amounted to 173 million TEUs, up 6.9% year on year, of which coastal ports accounted for 152 million TEUs, up 7.1%.

In terms of current shipping conditions and future trends, in the first half of 2025, the container shipping market remained in a fragile balance of supply and demand, with modest recovery in cargo demand. The Red Sea crisis continued to force vessels on the Europe routes to detour via the Cape of Good Hope, leading to deployment of larger-capacity vessels. The delivery of newly-built containerships kept supply at a high level. The ports in Northern Europe remained congested. Freight rates on Europe routes fluctuated, which dropped before rising, while rates on U.S. routes showed significant volatility. Global service networks and shipping alliances underwent profound adjustments, and the market structure of container shipping continued to be reshaped. In the long term, the international shipping market will remain highly concentrated. Trends such as vessel upsizing, alliance-based operations, digitalization, automation, greenization, and end-to-end logistics integration will continue. Liner companies are expected to accelerate consolidation through mergers, acquisitions, and capacity expansion. These changes will have lasting impacts on port development, particularly for international hub ports, which are required to enhance service capabilities, build smart, green, efficient, resilient ports, and expand into new logistics models and high-end shipping services.

For the port industry itself, despite external trade uncertainties, China’s imports and exports maintained stable growth in the first half of 2025, with overall port throughput continuing to grow—particularly in foreign trade container throughput. Going forward, although geopolitical conflicts and trade frictions increase global economic and trade uncertainties, the fundamentals of China’s long-term economic growth remain unchanged. The ongoing restructuring of global industrial and supply chains is expected to foster new trade corridors and highlight the importance of intra-regional trade. Economic and trade ties between China and the countries along the Belt and Road will continue to strengthen, and China’s import and export structure will be further optimized, directly impacting the port sector. Meanwhile, shipping alliances, vessel upsizing, and greenization will reinforce the role of hub ports and intensify all-round competition among international hub ports. Synergies between ports and hinterland multimodal transport will be strengthened, and stable cooperation–competition relationships among ports will emerge, driving high-quality development of regional port–shipping trade. Emerging business models in port and shipping logistics are thriving, with broad potential for ports to expand into digital platform services, e-commerce logistics, new trade models, and clean energy supply. The application of new technologies including 5G, AI, cloud computing, Internet of Things, big data, and blockchain will further enhance digitalization and automation, foster the development of digital port–shipping ecosystems, and empower the high-quality development of the port industry.

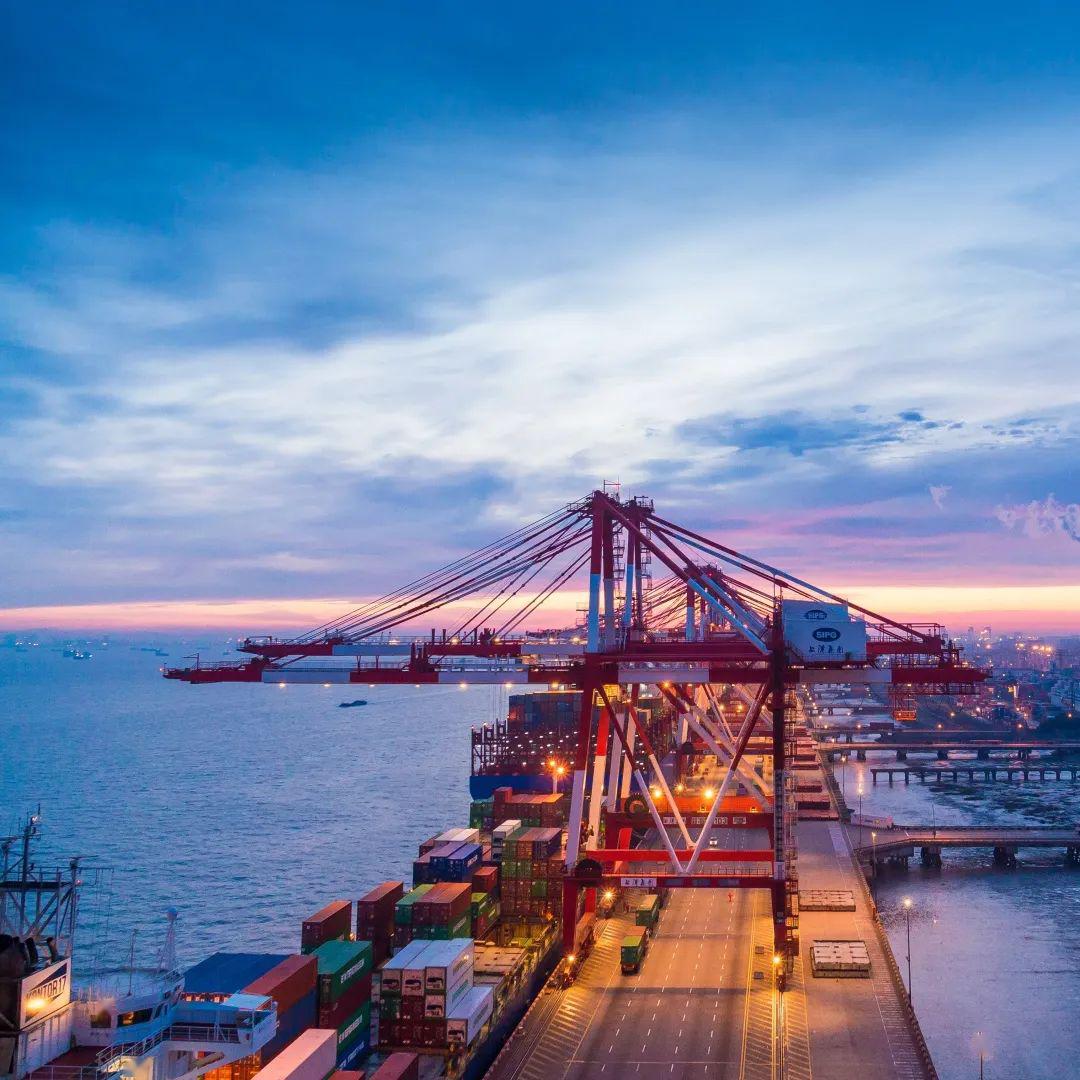

The Port of Shanghai is located in the central part of China’s east coast, at the intersection of the Yangtze River “Golden Waterway” and the coastal shipping corridor, forming a “T”-shaped water transport network. It connects southward and northward along China’s coastline to the world’s oceans, while extending inland to the Yangtze River Basin, rivers in Jiangsu, Zhejiang, and Anhui provinces, and the Taihu Lake system. With a well-developed network of highways and railways, the Port of Shanghai enjoys smooth intermodal connections, a superior geographical location, favorable natural conditions, and a strong economic hinterland.

Shanghai International Port (Group) Co., Ltd. (SIPG), which was established in January 2003 through the restructuring of the former Shanghai Port Authority, serves as the public terminal operator of the Port of Shanghai. In June 2005, SIPG completed its shareholding reform and was reorganized as a joint-stock company. On October 26, 2006, it was listed on the Shanghai Stock Exchange, becoming the first port operator in China to achieve overall public listing. Today, SIPG is known as the largest listed port company in China, as well as one of the largest port operators in the world. The Company is mainly engaged in port-related businesses, focusing on four segments: container, bulk and breakbulk, port logistics, and port services.

Its business scope covers: domestic and international cargo handling (including containers and transshipment), warehousing, forwarding, and multimodal transport; container stuffing/stripping, cleaning, repair, manufacturing, and leasing; international shipping, warehousing, custody, processing, distribution, and logistics information management; passenger cruise facilities and services; pilotage, towage, shipping agency and freight forwarder; ship bunkering and provision services; port facility leasing; port information and technical consulting services; port construction, management, and operations; as well as the wholesale and import/export of port cranes, handling machinery, electromechanical equipment, and spare parts.

The Company’s business model primarily consists of: providing port and related services to customers, and collecting all-inclusive handling fees, yard usage fees, and other port-related charges.

The Company’s major performance drivers are defined as follows: On the one hand, the overall state and trends of macroeconomic development have a significant impact on the growth of the port industry. On the other hand, total demand for port import and export cargo is closely associated with the economic development of the port hinterland, which plays a crucial role in shaping the generation and flow of container cargo, and directly affects fluctuations in port throughput.

The Port of Shanghai’s economic hinterland mainly comprises the Yangtze River Delta region—Shanghai, Jiangsu, Zhejiang, and Anhui—with its influence extending upstream along the Yangtze River to China’s vast inland areas and further into the Huai River Basin. The sustained, rapid, and stable economic growth of these regions is critical to the throughput of the Port, particularly container throughput. Overall, changes in the business volume of the Company’s core port operations will directly impact its operating performance.

Market Position: Since 2010, the Company’s home port has ranked first in the world in container throughput for 15 consecutive years, with its key operating indicators remaining among the industry leaders. In the first half of 2025, the home port handled 27.065 million TEUs, continuing to hold the top position globally.

As the Company continues to improve its capacity for sustainable development and service, its role as the primary hub port—serving the Yangtze River Delta, the Yangtze River Basin, and the Huaihe River economic hinterland, while extending its reach to the Belt and Road Initiative (BRI) and the Yangtze River Economic Belt—has been further strengthened. The Port of Shanghai continues to rank first globally in terms of foreign trade route connectivity, with its high-density, high-quality sailing schedules generating strong agglomeration effects. This has attracted major global liner companies to establish the Port of Shanghai as a core hub in their route networks, thereby enhancing Shanghai’s ability to allocate global shipping resources as an international shipping center.

The Company remains committed to aligning its development with the broader national agenda and continuously enhancing its capability to support national strategies. Through management, capital, and technology deployment, it actively advances the “southward linkage, northward integration, and westward expansion” initiative, while continuously optimizing an efficient, convenient, cost-effective, resilient, and green collection and distribution system. By vigorously developing multimodal transport—including water-to-water, sea-rail, and air-rail intermodal services—the Company has strengthened its port and shipping logistics capabilities in the hinterland, further enhancing its leading role across the Yangtze River Delta, the Yangtze River Economic Belt, and nationwide. The Port of Shanghai’s function as a strategic hub implementing the dual-circulation development strategy and as a key node in the BRI continues to become increasingly prominent.

To achieve its goal of becoming a world-class shipping hub, the Company is developing its port focusing on “intelligence, green development, technology, and efficiency.” Based on the “1+3” strategic framework, it continuously pursues new breakthroughs in “emerging technologies, new regions, and new business models” to enhance corporate value creation. The Company is devoted to strengthening, optimizing, and expanding its core businesses in port operations, port investment, and port logistics services, building capabilities for sustainable, high-quality development. It strives to serve as a key driver in elevating the capacity of Shanghai International Shipping Center and to play an increasingly important role in supporting national strategies and the building of Shanghai’s “Five Centers.”

The Last: Shanghai Port Supports the Maiden Voyage of “Gemini“, se...

The Next: none

2024-08-15

2024-09-06

2021-02-08

2020-05-29

2024-12-25